Payment Journey Redesign at William Hill

From 68% to 42% Abandonment Rate

£14.4M Annual Revenue Impact

4-Phase Strategic Transformation

Led end-to-end design for 1.7M users across William Hill, Mr Green & 888casino, one of the world's leading sports betting and gaming companies.

-

I'm a Senior Product Designer in the Global Design Team at Evoke PLC (formerly 888 Group), specializing in AI-driven design solutions, scalable design systems, and complex financial product experiences. Working with a multicultural team across international offices, I design for three major brands: William Hill (UK), Mr Green (EU), and 888 (EU/US markets)—all unified through a sophisticated multi-brand, multi-language design system.

While my primary focus has been on Payment journeys, I've also led KYC (Know Your Customer) experiences and actively collaborate with the AI team to bring AI-driven initiatives to product development. I bridge the gap between AI capabilities and design solutions, introducing AI perspectives to the design team and ensuring our products leverage emerging technologies to improve user experience and business outcomes.

-

William Hill's checkout had 68% abandonment—23% above industry average, costing £2.3M monthly in lost deposits.

Critical Issues:

7 screens to complete deposit (competitors: 3)

3:12 average completion time (competitors: 45-90s)

No saved payment methods or digital wallets

5-year-old infrastructure vs. modern competitors like bet365

My Role: Lead designer owning the complete redesign—from discovery research to implementation and measurement across product, engineering, compliance, and data teams.

Discovery & Strategy

Research Approach: Partnered with UX research team to journey map 15 critical friction points, conducted competitive analysis of 8 platforms (bet365, Paddy Power, Stripe, PayPal), and facilitated stakeholder workshops with 12 participants to align on strategy and prioritize solutions.

Strategic Workshops: Organized three collaborative working sessions with product management, engineering, compliance, and business intelligence to validate findings, assess technical feasibility, and prioritize solutions. Through card sorting exercises and impact/effort mapping, we aligned on the phased approach and secured stakeholder buy-in—transforming potential blockers into project champions.

Strategic Insight: Rather than a simple UI refresh, we identified an opportunity to create personalized, data-driven deposits—balancing conversion with responsible gambling while addressing immediate technical and regulatory constraints.

The Solution:

4-Phase Transformation

One of my primary responsibilities was aligning design ambition with engineering reality. Through close collaboration with the development team, I mapped out which features could be delivered in what timeframe, always prioritising solutions that would deliver measurable user value quickly. This partnership resulted in a phased delivery strategy—initially 3 phases, later expanded to 4 with the introduction of AI-powered deposit intelligence—ensuring we could iterate based on real user feedback whilst maintaining momentum.

-

Behavioral data-driven "Quick Deposit" amounts replacing manual input

Designed and tested 5 UI variations for personalized amount suggestions based on user transaction history. Collaborated with data team to define the personalization algorithm while maintaining manual input as a fallback option.

Impact:

+27% average deposit value

+£1.2M monthly revenue

Minimal engineering effort, immediate results

-

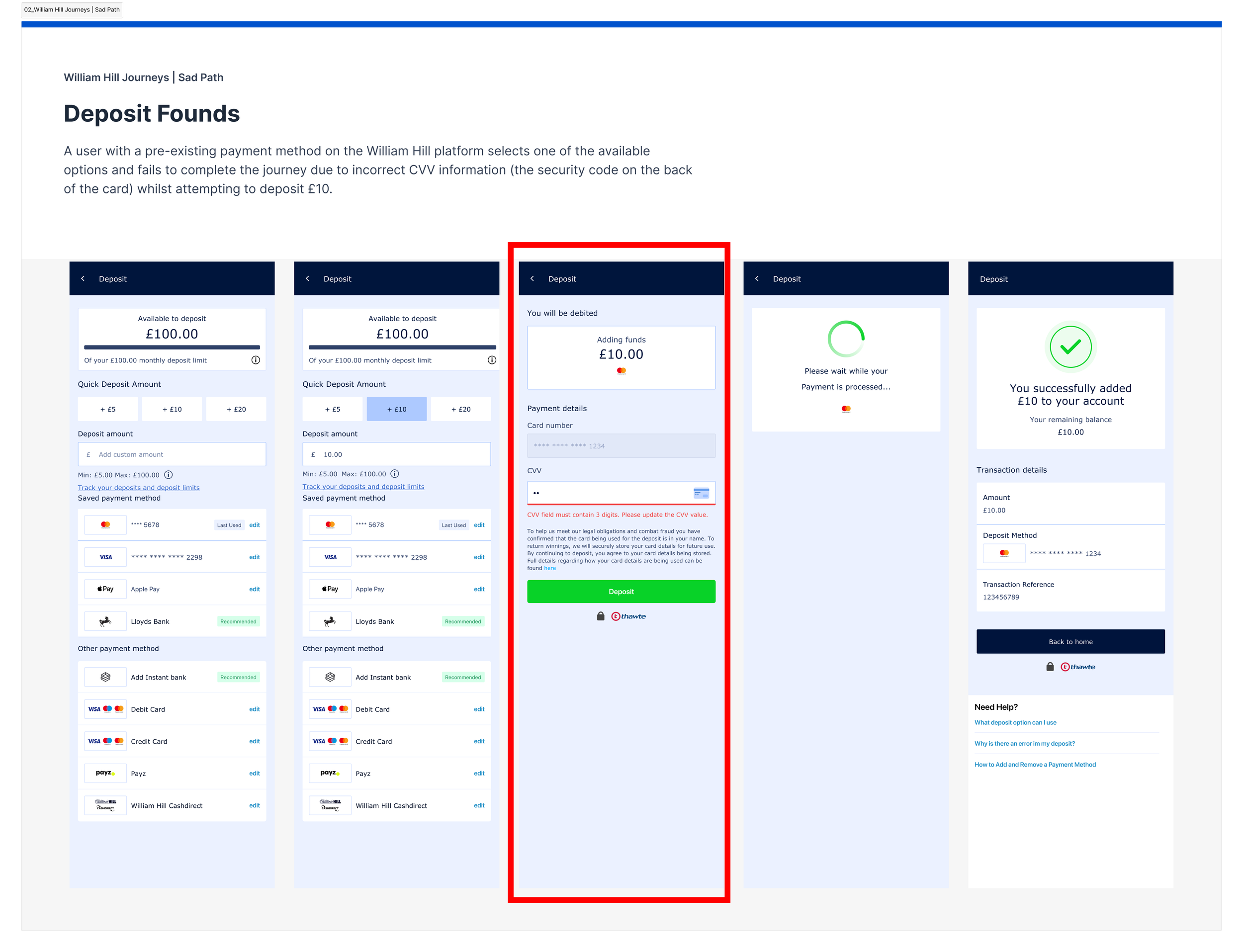

Reduced journey from 7 to 3 screens with intelligent defaults

Key Design Decisions:

Combined payment method selection with amount input

Implemented payment method memory and tokenization

Designed inline validation preventing errors before submission

Created smart defaults based on user history

Impact:

Completion time: 3:12 → 1:45

Abandonment: 68% → 51%

-

Market-leading payment capabilities establishing competitive differentiation

Introduced one-click repeat deposits for returning users, integrated digital wallets (Apple Pay, Google Pay), and designed biometric authentication options.

Impact:

Abandonment: 51% → 42%

Positioned William Hill ahead of traditional competitors

-

Smart Deposits prioritizing responsible gambling

Designing the next evolution: AI-driven suggestions based on user-set deposit limits, daily betting patterns, win/loss ratios, and time-based spending habits. The system will never exceed user limits, detect cooling-off periods, and automatically suggest lower amounts after losses.

Expected Outcome: Enhanced user protection while maintaining conversion rates through real-time risk assessment and machine learning.

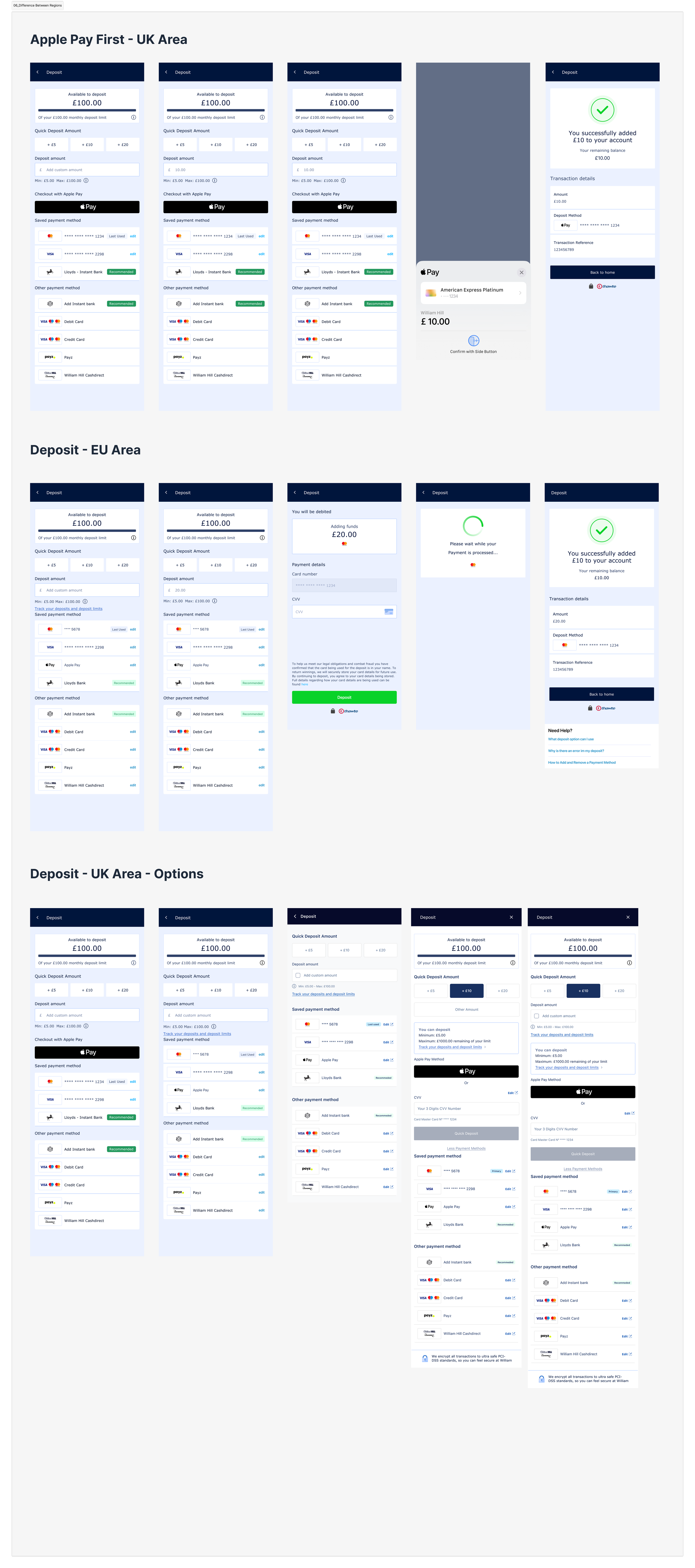

Regional Strategy: Global Product, Local Optimisation

Recognising that payment preferences vary significantly by market, I developed a regionalised approach that balanced global product consistency with local user behaviour.

Market-Specific Implementations:

UK Market: Apple Pay-First Approach Designed a checkout variation prioritising Apple Pay as the primary payment method, eliminating CVV friction entirely. This strategy leveraged the UK's position as having the world's highest Apple Pay adoption rate, maintaining full regulatory compliance whilst significantly reducing abandonment.

EU & Other Markets: Unified CVV Integration For regions with lower digital wallet adoption, I designed an alternative solution integrating CVV input within a single unified screen. This maintained the streamlined 3-screen journey whilst meeting legal requirements.

All Markets: Enhanced Quick Deposit Across all regions, I redesigned the manual input experience to feature "Quick Deposit" preset amounts as the primary interface, with manual entry as a secondary option—improving both UX and average deposit values.

Testing Framework: Deployed multiple checkout variations simultaneously across different markets, allowing us to gather real-world performance data and iterate based on regional user preferences. This approach ensured we weren't forcing a one-size-fits-all solution onto diverse user bases.

Design Philosophy: Turned regulatory constraints and regional differences into competitive advantages by understanding local payment behaviours and adapting our solutions accordingly—proving that global scale doesn't require sacrificing local relevance.

Measurable

Impact

More About the Company

Leadership & Thought Leadership

Post-Acquisition Integration Success

My Approach:

Conducted extensive audits across all three companies' user journeys

Mapped unique needs and existing design elements

Created comprehensive documentation system via Jira tickets

Provided real-time visibility to executives and design teams

The Result: Successfully established design consistency across the organization, enabling the first full year of integrated operations in 2024.

Design Team Deliveries Wrapped

After the unification of the three companies, 2024 marked the first full year of integrated operations. This video, presented to the executives, highlights the Q2 achievements of the design team, showcasing their work under a unified design system.

This video is just an illustrative way of showing the design team's work,

produced by the company's marketing team.

View More Projects

-

Evoke & William Hill

Evoke PLC is a global leader in the sports betting and gaming industry, owning and operating some of the world’s most recognised and trusted brands. With a portfolio that includes William Hill, 888casino, 888sport, 888poker, and Mr Green, Evoke delivers premier entertainment experiences to millions of customers worldwide.

-

Google

Development of an AI-powered feature for Google My Business, enabling business owners to streamline profile management, analyse customer feedback, and identify behavioural trends.

-

NHS

The project involved modernising multiple dashboards within a unified NHS platform to align with the updated Design System. With the previous design spanning over a decade, significant updates were necessary. Workshops with NHS stakeholders identified key areas for improvement, ensuring the redesign enhanced user journeys. Design elements from the NHS Design System were seamlessly integrated into the new workflows, improving usability and ensuring consistency across the platform.

-

Truphone

Truphone is a global mobile network operator specializing in seamless connectivity for travelers and businesses. Leveraging innovative eSIM technology, it enables users to switch between multiple mobile networks without the need for physical SIM cards. Truphone’s offerings include international data plans, mobile device management, and secure, reliable global communication solutions.

-

Carrefour Bank

Carrefour is one of the largest supermarket chains in France, with operations worldwide. In South America, in addition to its supermarket operations, Carrefour offers a credit card designed for users with limited financial resources. The project aimed to expand this offering into a full everyday account and credit card solution, enabling users to manage their daily transactions—such as salary deposits, prepaid phone top-ups, and public transport card recharges.

-

GK One

GK is the largest product holding company in Jamaica and Central America, where it operates from food products to financial products. With significant market share in Europe and North America.

-

Bradesco Next

Bradesco is the biggest Brazilian bank. Long-established, its goal is to attract new clients from younger generations that haven’t yet opened a bank account. As a mean to accomplish that, their strategy was to release a new brand to target younger audiences that hadn’t yet related with the brand. Therefore, the main goals were: attract and target younger audiences / enable access to a financial institution.